Maintenance

MAINTENANCE

Maintaining policies and procedures to a high standard reduces your operating risk.

Changes to service provider software and their requirements of you will require your policies and procedures to be up to date at all times. Changes to regulatory requirements, particularly, new requirements may require new policies and procedures.

ASIC requires some of your documents to be reviewed at least annually. Well management companies have in place good document control processes that are in accordance with the ISO council of Australia standard, ISO 9001

There are three good reasons to keep your documents up to date and to a high standard. These are:

1. Reduced business risk,

2. Pass regulator surveillance,

3. Pass examination by due diligence companies and clients.

Reduced business risk

Poorly maintained documents can lead to expensive mistakes, particularly they a person using them is unfamiliar with the task at hand, for instance someone new to the position.

It might be as simple as software update not being reflected in an operating manual, resulting a task not being completed, or wrongly completed. When you are managing client money, this may be financially very costly.

Pass regulator surveillance

Regulars are interested in your compliance with current Laws and the conditions and authorities granted on your AFSL. As there are continuous modifications to various, Laws and associated regulations, they expect you to reflect these changes in your documents.

We have known of a trivial change in terminology not being reflected in a policy document to generate a letter from AUSTRAC (for example, a change from referring to a Compliance Officer, to Compliance Manager. Same job, but AUSTRAC said it was proof that documents were not up to date, and issued a warning letter).

Pass examination by due diligence companies and clients

Clients want to know if they are dealing with a properly run business before they provide funds to manage.

They often employ independent due diligence companies to review all documents, policies and procedures seeking out for example, inconsistencies between them and whether or not they are up to date. Sometimes potential clients have their own due diligence teams.

If you fail examination, you won’t get the funds to manage.

If you do pass examination, you will be subject to regular examination. If you pass the first examination with a high score, you next examination might be in two years. If you pass with a low score, the next examination might be as short as 6 months.

How we can assist you

Our documents, policies and procedures have always been highly rated by due diligence companies, clients and service providers (e.g. custodians).

Start ups

With over 300 high quality documents, policies and procedures in our Library, we quickly and inexpensively apply these to your business, after adjustment to your business’s specific needs.

This will save you a great deal of time and money.

Established AFSL holders

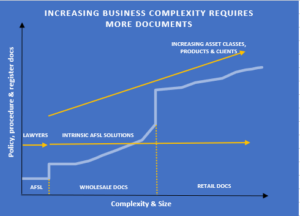

As you grow your business, particularly if you take-on institutional clients, you will need a greater number and diversity of documents, policies and procedures. They will also need to created to a high standard.

See chart below

We offer you the following:

A. Access to our document library (over 300 high quality documents). We will make the necessary changes to these documents, policies and procedures to suit your circumstance.

B. A document review service, through which we can identify possible improvements for your considerations. Further, we can make proved changes to documents, procedures and policies, if you wish.

Support

Support

There are many ways we can help established and start up advisory businesses.

AFSL Solutions

AFSL Solutions

We are focussed on entities who have or want a Australian Financial Services License.