New AFSL Holders

We are the epicentre of your requirements as an ASFL holder. If we can do it ourselves, we will find quality cost effective service providers that can. We can help your business grow.

Once an AFSL has been awarded, Intrinsic takes over where your Lawyers left-off.

We take the proofs and other documents created in support of the AFSL application and ‘give them life’ by embedding them into the daily operations of the new AFSL holder, thereby ensuring that they live up to the undertakings given to ASIC by the directors.

With a library of over 300 policies, procedures and registrars that can be modified to your specific front, middle and back office requirements. These documents are not templates for you to complete.

Access to this vast range of resources will save you a great deal of time and effort because you won’t have to create them yourself. The time savings are not in a week or month, but in tens of months. The number is relative to the scale and complexity of your business.

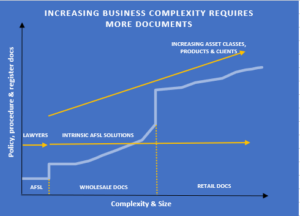

The following chart provides an illustration of the increase in documents required as your business grows in complexity. The documents required to obtain an AFSL are a fraction of what you will need to establish and grow your business.

What follows are some of the matters that you will need to address if you are to grow your new business beyond start up.

GOVERNANCE STRUCTURE

ASIC does not prescribe what corporate governance structure is suitable for your financial services business. You are expected to create your own that at lease ensures you meet your obligations under the Law and associated Regulations.

In conjunction with you we can devise a governance structure and associated charters and polices that meet these obligations and will win approval from institutional clients, due diligence companies and auditors, such as GS 007 auditors.

COMMENCEMENT

We can advise on the selection and arrangement of service providers, all with an eye on keeping operating costs to a minimum.

Structure of internal networks and links to external networks (e.g. custodian and other service provider networks, settlements, attribution) be automated as much as possible in order to minimise costs and reliance on humans.

Small teams tend to have a heavy reliance on an individual or two to carry out a critical daily function, for example the overnight reconciliation institutional client cash and holdings recorded by your client’s custodian and the same recorded by your provider. You would be surprised how often there are significant variances. These need to be reconciled before trading opens, if only they can produce compliance breaches by your client’s custodian, and you don’t want those. They lead to the client losing confidence in your company and you. If they think you are sloppy in the back office, they may think you are sloppy with their portfolio in the front office as well. If so, they won’t be a client for much longer.

We can show you how minimise key man risk across, back, middle and front offices.

OPERATIONAL

Aside from the obligations you have under Law and regulations you also have contractual obligations to clients and service providers. We take the contractual obligations made to clients and service providers and weave them into the policies and procedures of investment managers and financial planners.

We can assist with improvements or growth in your back office services using our operational and compliance experience to develop a commercially realistic back office and assist in areas such as:

- Performance reporting,

- Liaison with custodians and administration system providers,

- Investment committee functions and process’s,

- External asset consultant reviews and assessments.

EXTENSIVE LIBRARY OF POLICY AND PROCEDURE DOCUMENTS AND REGISTRIES

You can be granted an AFSL with having a relevantly small number of documents required by ASIC (i.e. proofs).

But you cannot win clients without an extensive set of documents to properly manage retail and institutional (wholesale) client portfolios.

EMPLOYEE SHAREHOLDERS AND INCENTIVE SCHEMES

We are experienced in the areas of employee shareholder schemes and personal incentive schemes.

We can advised you on the pros and cons of using ownership as and bonus schemes as individual employment incentives.

Team stability is an area that institutional investors and gatekeepers to funds to manage usually focuses-on when assessing a funds manager and it is very important that you get this right for all stakeholders.

WINNING and MAINTAINING CLIENTS

Then there are the massive number of documents and procedures that must be created in order to have a chance at winning approval from the gatekeepers to institutional funds (e.g. asset consultants, investment platforms, trustees) as well as the due diligence companies appointed by institutional funds to ensure that the AFSL holder is a properly managed business as seen to be so.

The same is true to win support from financial planners and their gatekeepers (research houses and custodians) but to a lesser extent.

All of what Intrinsic offers increases the likelihood that the AFSL holder will win grow and retain clients and retain their AFSL and satisfy the requirements of other regulators and service providers.

We also reduce the risk losing clients and their gatekeepers.

Once a client is lost and/or gatekeeper adopts a negative opinion of the AFSL holder it can years to win them back.

With a library of over 300 policies, procedures and registrars that can be modified to your specific front, middle and back office requirements. These documents are not templates for you to complete. They are fully written and merely need modification to suit the needs of your business. This will save you a great deal of time and money.

This vast library of policies, procedures and registrars has been successful at winning gatekeeper support with the knock-on effect of winning client support funds to manage.

MAINTENANCE

Once established we offer a full monitoring services, enabling you to stay up to date with the every changing requirements of Regulators, client service providers, Australian Standards organisation and clients. Where necessary we can write new policies and procedures and/or adjust existing documents, thereby ensuring that you are always up to date.

COMPLIANCE AND RESPONSIBLE MANAGER FUNCTIONS

We are able to supply Compliance Officers and Responsible Managers to your business.

Support

Support

There are many ways we can help established and start up advisory businesses.

AFSL Solutions

AFSL Solutions

We are focussed on entities who have or want a Australian Financial Services License.